Nearly half of the Bitcoin market is controlled by only 2500 accounts. Were there any collaboration between some of these ‘whales’, then given the relatively thin volume on trading Bitcoin, these whales would be able to have a huge amount of sway over the rise and fall in the Bitcoin price.

Bitcoin is still a very young asset, only having come into existence 12 years ago in 2009. Earlier this month the number one Cryptocurrency posted a new all-time-high of around $42,000 per Bitcoin, helping the combined Cryptocurrency market cap to surpass 1 trillion dollars.

It is said that single trades by one of the big whales can lead to a swing in the market, either up or down.

A collaborative report between OKEX and data firm Kaiko looked at how retail investors, professional investors and whales were buying and selling. In the last week of November, the report concluded that as retail investors continued adding to their positions, whales were selling, leading to those small-time investors being trapped in their positions in the short to mid-term as the price fell.

In all likelihood, many of the retail investors would have then sold, leaving the whales to hoover up this Bitcoin as the price went down. The report finished by stating:

“large traders, whales and institutions are in the business of buying low and selling high. It is not in their interest to continue buying coins at new highs and making them even more expensive.”

With regard to the whales, it also said:

“they seek to drive the market, shake out retail traders in panic and capitalize on opportunities to buy relatively cheap coins.”

Bitcoin whales are individuals or companies that have extremely large Bitcoin holdings. Some reference the amount of 1000 Bitcoins as being the quantity of Bitcoin needed to be a whale. However, with prices generally rising that figure is changing.

The fact that 18 million of the entire 21 million Bitcoin supply has already been mined, adds to the value of what is already in circulation. When you also factor in estimates that as much as 5 million Bitcoin have been lost forever, then those who have large holdings of Bitcoin are wielding an ever more powerful influence over the market should they choose to use it.

The creator of Bitcoin, Satoshi Nakamoto, is rumoured to have about 1 million Bitcoin. Since his disappearance after Bitcoin was launched, his Bitcoin wallet has remained untouched, leading to further speculation on what would happen should this wallet become active once more.

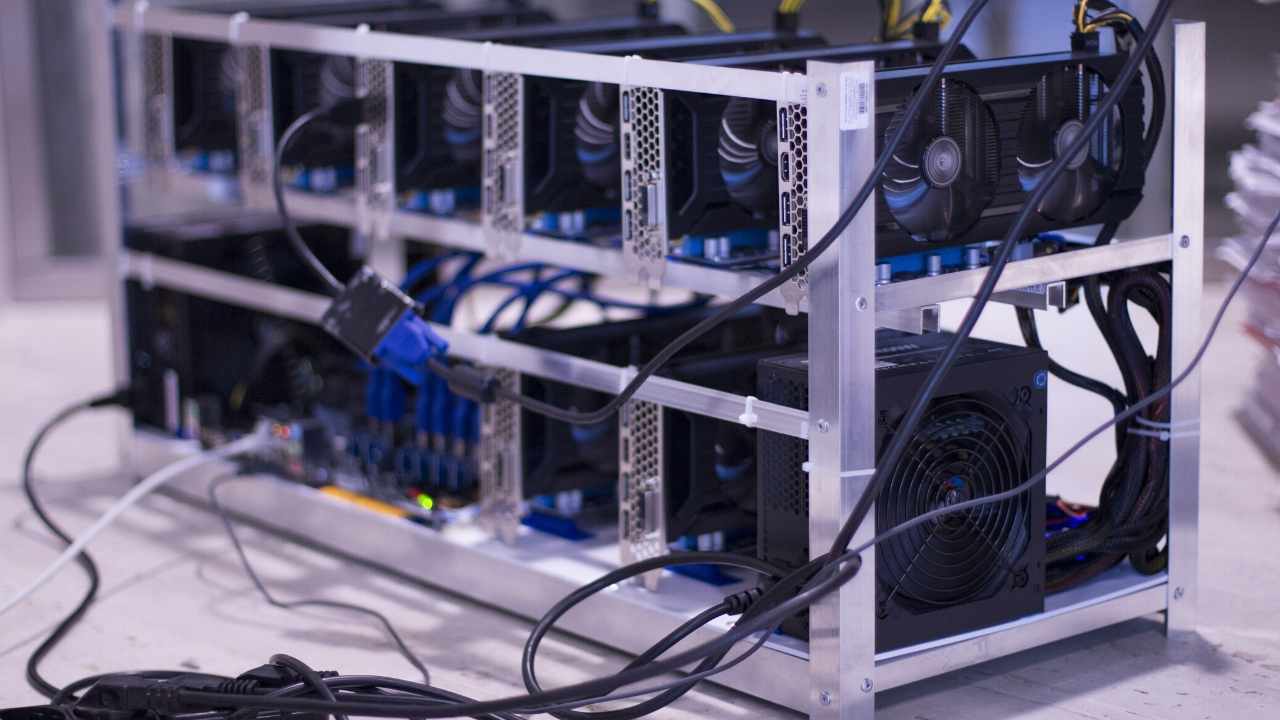

Some of the other top whales include in second place, Micree Zhan, joint founder of Bitmain, which controls two of the largest Bitcoin mining pools. In third position is surprisingly the Government of Bulgaria. Bulgaria’s Bitcoin value holding surpassed the value of its gold reserves when it seized massive amounts of Bitcoin after raids on Cyber criminals operating in the country.

One other extremely large holder of Bitcoin is the FBI. Its holding was obtained back in 2013 when it closed down the online illicit market place known as ‘The Silk Road’.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

This article originally syndicated from Whales own 40% of all Bitcoin – are they manipulating the market?

No comments:

Post a Comment